See This Report on Self assessment online - Money Donut

How Taxes - Texas Comptroller can Save You Time, Stress, and Money.

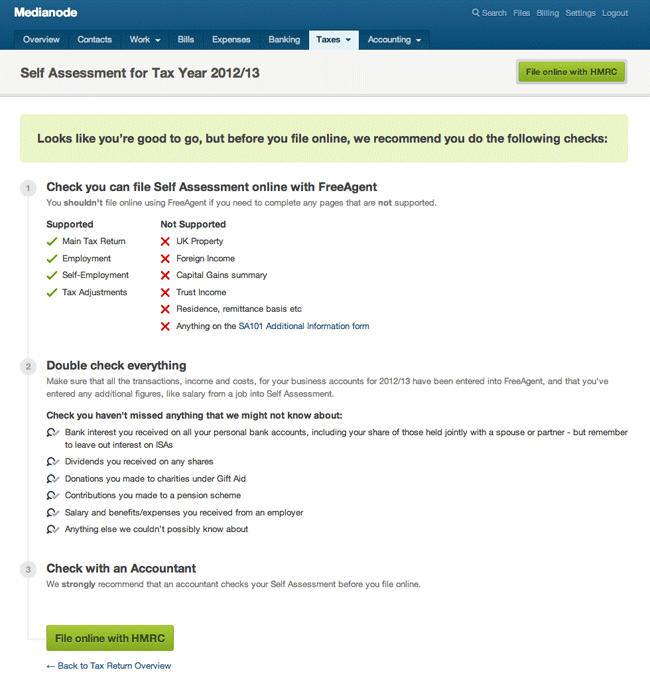

Registering for self evaluation online There are different ways to sign up for self assessment online, depending upon whether you are self-employed and whether you have actually already registered for self assessment. If you have actually finished a self assessment tax return previously, you will need to discover your tax recommendation number (UTR).

Go, Simple, Tax makes your self evaluation tax return fast and easy, helping you figure out which costs and allowances you can claim. You can likewise register for online services if: you are already signed up for self evaluation, and now wish to file online instead of using paper returns; you don't require to file self assessment returns, but wish to be able to use your online individual tax account; you desire to utilize other HMRC online services (for instance, other company taxes).

The Super Easy new way to get access to your HMRC Personal Tax and Self Assessment Account

You may currently have one (for instance, if you are self-employed and have registered for VAT). If not, this will be developed as part of registering. Your individual tax account Signing up for self evaluation online immediately offers you a individual tax account. You can utilize this for jobs like: completing your self evaluation tax return; inspecting your PAYE tax code and approximated tax costs; giving HMRC upgraded information like a modification of address; managing tax credits.

Claim to reduce payments on account - Alterledger

Self-employed or a high earner? Don't miss the upcoming self - Questions

This includes the essential company taxes that require to be handled online, like barrel and PAYE. Self assessment online aid There is a series of HMRC aid with self assessment. A Good Read can If you have desire to discuss your individual tax affairs, or choose to get phone guidance, call the HMRC self assessment helpline (0300 200 3310).

Making Tax Digital will enable info to be sent straight to HMRC utilizing software, instead of needing to complete a self evaluation return. This ought to make things easier and quicker, and decrease the danger of errors. Making Tax Digital started with VAT for businesses in April 2019. VAT-registered organizations are now needed to use the service to file their barrel returns.

Self Assessment Tax Return Accountant Service Near Me - Online

You can join the Making Tax Digital pilot for earnings tax if you wish. The Government has held off the execution of MTD for the functions of income tax for the time being. You can learn more with HMRC's aid and support for Making Tax Digital.